Watching the television show “American Greed” recently, I heard one of the investors exclaim that he was going to make a 10% return on his investment.

Ten percent? Ten percent, for a land flipper, isn’t exciting at all. It’s sure not worth putting a guy on TV.

People do this all the time with stocks, lauding how they are investing in high yield mural funds that return a whopping 10% a year.

Our land investments aren’t passive, that’s true, but we frequently make a 100 percent return. The numbers are possibly double that, since we often flip in six months or less. Some of the most-difficult flips we have done have been completed in a year. Quick is three months, normal is six.

I know you are probably dubious, so let me offer the example of a recent deal which our family worked through – to show how we turned $25,000 into nearly $100,000. We told this same story in our latest book.

The twenty acres had been on the market for a while. First at $120K, then at $100K, and then $90K. These guys really wanted to sell. Not messing around.

We had been watching it the whole time. The RE agent had simply stuck it in the MLS. No Craigslist, no post on the local Facebook real estate board. He did put up a sign on the property, but it was well off the beaten trail. Only the immediate neighbors would have seen his sign.

Sometimes real estate agents aren’t as hungry as we are, I guess.

A normal person, in the area and looking for land, wouldn’t even know this tract was for sale. If they did find out somehow, they wouldn’t have access to a plat. So they would have no idea where the land was, how it fit together, where the corners or property lines were, etc. (Heck, the average prospect might not even be able to get the agent to call them back.)

The thing is, you had to be an expert in land to be able to find and appreciate this particular piece. You had to be on the ball, searching thoroughly through the MLS to even know that it existed. Then you had to be able to research it, to understand it, to evaluate its strengths and weaknesses all on your own. No one, especially not the agent, was going to hold your hand through this. (Don’t worry, though, because we will).

In short, it is this niche skill that gives us the 100% RoI. The ability to recognize and understand raw land.

You’d be surprised by the deals out there if you just persist in your search. You’ll find amazing deals down some dirt road and think, “Why the hell are people on TV bragging about ten percent when deals like this are just sitting there?”

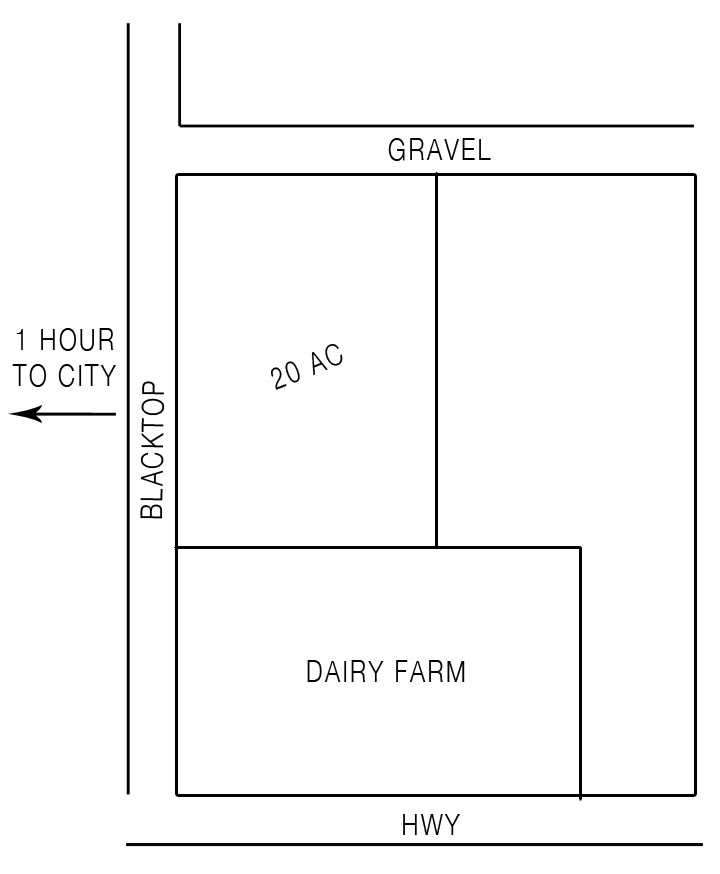

Anyway, this 20 acres was pretty much perfect for a flipper. Long frontage, beautiful location next to a dairy farm, nice topography. I researched it on my maps; no apparent problems. I went out and scouted it; looked good.

Here is a drawing to show you the layout:

So they wanted $90K. Our problem was that we didn’t have ninety, not in cash anyway. We almost never do. All of our cash goes into dirt or into real estate notes on that dirt. (See how we arrange our real estate notes in the latest book.)

Anyway, the steady flow of lot sales is how we put food on the table, after all, and in this business, sitting on large sums of cash rarely makes sense. Some deal comes along and, presto, we own more inventory.

But this tract was just too appealing to pass up, so we decided to try for the owner financing angle.

I called the listing agent. As we spoke, I probed him about the possibility of owner financing.

“Oh, no. The owners really don’t want to do that. I’m sorry.”

“Well, that price is a bit too high for me anyway,” I said. “But could you let me know if there’s a price drop?”

I called again a while later. Remember that even if you get a flat out “No” on the owner financing question, it could just the agent not wanting to mess with a complex deal. Always call and try again, especially if the land sits there on the market.

A month later: “Are you sure they won’t do that?” I asked.

“Pretty sure. I mentioned it to the sellers, but they’d really rather have cash.”

Two months later I called again. By now, the agent was taking me seriously. If a buyer keeps calling you about a property, you tend to remember him.

“Owner financing?” I asked.

“Well, maybe,” he answered. “Let me check on that again.”

The next day, he called back. “Would you be willing to meet with the sellers, to discuss things? They’d like to meet in their lawyer’s office.”

“Yes. I’ll be there.”

At the meeting, I tried to look and sound as professional as possible. As upright as possible. If someone’s going to lend you money, make them believe in you. We generally talked and had a good meeting. My goal was to make them feel comfortable.

On my way back home, I got a call from their lawyer. “Can you explain to me exactly what your offer would be?” she asked.

“Well, I’ll pay $70,000 cash, or I’ll pay $80,000 if they’ll finance it with $20,000 down. But here’s the thing. Their note can’t contain a due-on-sale clause. That’s because I intend to sell to my lotbuyers with owner financing, but I’m going to wrap the first mortgage. I can’t be forced to pay your clients off when I sell some of the land with owner financing.”

I could hear the lawyer thinking. It was apparent that she was having to rearrange some mental cobwebs. Not so many people are fluent in the language of ‘wraparound mortgages’ and ‘due-on-sale clauses’. Neither were the sellers in this case. We had to explain it to them.

Knowledge is power.

“So you plan to sell a 5-acre tract for, let’s say, $35,000, and take a $35,000 note. But with an underlying mortgage to my sellers for $60,000? You’re not going to release that 5-acres from the $60,000 mortgage?”

“Yes ma’am. That’s how it would work. My lotbuyer would buy his property ‘subject to’ your clients’ mortgage. I think I can convince my buyers that it’s safe enough to do that.”

“I’m sure you can,” she answered. She knew that weak buyers would be happy to take a chance like that – especially if they felt good about me personally – if it meant they could acquire a property, even with shitty credit.

“Well, but is that dangerous to my sellers?” she asked.

“Oh, no. It’s a bit dangerous to my lotbuyers, of course, in case I default on the underlying note – which I’m not going to do – but not dangerous at all for your sellers. They’ll still have a mortgage on the whole place, the whole 20 acres.”

“Let me talk to them again,” she said.

“Also,” I added. “I’ll need some partial-release language in the note. If I sell an acre for cash, your sellers will get a lump-sum payment and release that acre from their mortgage.” I was setting it up. If I sold one acre, I wouldn’t have to pay off 100% of the mortgage. I’d only have to pay 5% of the mortgage. (1 acre of 20 acres = 1/20th of the original mortgage balance.)

And that was that. The closing was set and I had a new twenty-acre piece of dirt. In the end, the total sales price was $75,000, with $20,000 down and the rest financed over ten years at 10 percent. I was now paying something around $700 a month to the seller-lenders, which meant the clock was ticking.

Pressure like that is a powerful motivator. And we made our own luck.

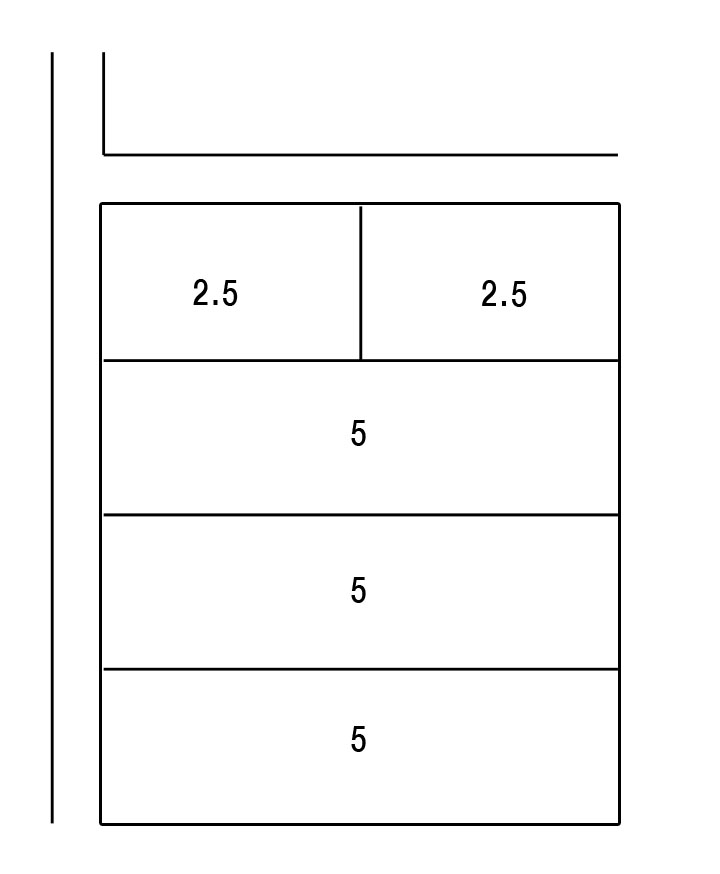

Here is how we divided up the property

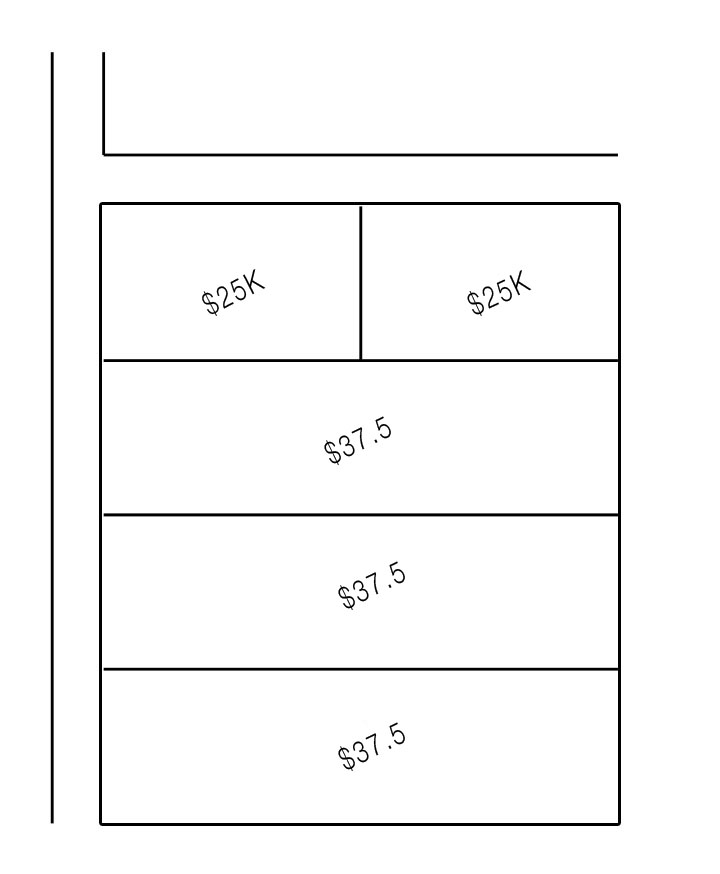

Here is how we priced them

We budgeted about 5 grand as follows

| Survey | $2,000 |

| Monthly payments out of pocket | 750 x 3 = $2250 |

| Advertising and fixup cost | $ 500 |

We did very little work on the piece aside from brush cutting. We mowed down the places that were overgrown, built fires and raked leaves. We turned it from the impenetrable wall of bramble that the real estate agent had been hawking, and into a walkable, park-like area. We also cut two of the main property lines through the woods, making them easily (and safely) walkable for our lotbuyers. It took us about two weeks of sweaty days and a few hundred dollars in tractor diesel and hamburger lunches. It was actually kind of fun and at the end we had a beautiful place. I wish In case you are unfamiliar with the “mowed grass principle” which I harp on quite a bit in the Land Flipper Course<Link>, doing this little bit of work makes a huge difference when you get ready to sell the property.

Now we were ready to sell. I’m not going to go into all the marketing techniques we used here. Here is my post on marketing land.

The first lot sold for $39,500. We collected a $5K downpayment and financed the rest at 10 percent over 10 years. In doing so, we “wrapped” the note. This is called a wrap-around mortgage, and you can read about it in the book.

So now we have $5K of our $25K out-of-pocket money back, and we are collecting a $450/month note and paying it into the $750/month note.

Just as soon as we’d gotten that accounting done, here comes our second buyer. He’s got cash, so he gets a better deal. A $31,000 check has that effect on us.

Of course, this second five acres has to be officially released before we can turn the deed over to Mr. Cash Buyer. Fortunately we had a release agreement with our original sellers. $4K/acre.

This means we have to give them $20K of our $31K check.

But now we’ve got $16K cash back of our original $25K output. Only now instead of owing $55K against the property, we only owe $35K. And of course, we hold a $35,000 note from our first lot buyer. We have broken even, and we still have half the land left.

Basically, in the course of 3 months, we’ve gotten ourselves two, 5-acre tracts, absolutely free.

During the next month, we had several people put down cash deposits on the remaining lots, and then walk away. It’s crazy – why they did that – but it’s what they did. We put that $4K in our pockets.

We sold our third lot to a relative of the first buyer for $36,500 cash.

Then someone gave us three grand down and signed a note on both lots up north for $39,500.

She also put $2,000 in escrow which was supposed to go toward the price of a septic tank (which improves the land and thus our collateral).

The problem was, this lady seemed intent on not paying us. The payments quickly stopped coming. We couldn’t get her to talk to us. So, we offered her the $2K in escrow back if she would just sign the deed back over to us. In the end, we made about $5K off of her in three months of letting her own the land. We were generous and patient with her, and we gave her two grand she didn’t deserve just to avoid having to take the thing to court. In case you are wondering, no, we don’t feel guilty about repossessing people’s land when they don’t pay us. Probably because the banks that we owe on our various mortgages have even fewer qualms than we do.

Anyway, this all gets a bit confusing number wise, but all together the profit was around $65,000. Half of which is in notes at 10% interest.

At the end we had all of our money back, an extra $35,000 cash and a 35K note that pays us $460 a month for ten years. The turnaround time was about 90 days, and all together we probably put 100-200 man-hours into the project. (Maybe less.)

Still want to invest in the stock market?